IRD says sort your tax!

12 Jun 2024, News

In a last-chance warning to the construction sector, the Inland Revenue Department (IRD) is telling businesses and sole traders to do the right thing and get on top of their tax obligations by the 7 July deadline

IRD’s Richard Philp says his team is ready to help those who “do the right thing” and seek out and follow up with those who don’t.

“Most people and businesses in New Zealand pay tax in full and on time but there is a core group who don’t,” said Philp.

“We’re not blind to the fact that businesses in the construction sector have struggled with increases in the cost and availability of materials, and labour shortages over the past few years. But we also know that while some are struggling just to keep up with the everyday grind, others are actively avoiding their tax obligations.”

Declare your cashies

Tax debt is high in the construction sector and IRD data shows that under-declaring income, often via cash jobs, is commonplace.

Each year, across all sectors, IRD gets nearly 7,000 anonymous tip-offs about cash jobs and the like. Construction is the industry most often anonymously reported. The department believes that shows a level of concern by New Zealanders and their belief that paying the correct amount of tax is the right thing to do.

IRD took a ‘softly, softly’ approach across the board during the pandemic years but that has now changed. We ran a campaign last year to help construction businesses do the right thing and now we’re taking an even firmer approach.

“The message is: ‘cut the excuses, ask us for help if you need it, and don’t stick your head in the sand’; otherwise, you could find yourself talking to someone from our audit team or, worse still, staring down a prison sentence, as several people in other sectors have this year,” said Philp.

“Now is the last chance for people working in construction to sort their tax affairs and avoid finding themselves before the courts.

“In a couple of months, we will send emails and letters to 40,000 construction customers with outstanding debt, overdue tax returns, or both. We’ll then text about 2,500 of those customers asking if they would like support to get their outstanding tax sorted. Those who reply “yes” will be contacted via phone by a dedicated team of compliance officers.

“Our compliance officers will be doing site visits in high construction areas in key locations across New Zealand. Our audit team will also be looking to select a number of customers to follow up and investigate.

“Do the right thing and get your outstanding debt and returns sorted now!”

Information to help the construction sector nail tax this year is available at Tax toolbox for tradies (ird.govt.nz).

A warning

Inland Revenue has taken construction firms to court for on tax charges before. In February 2024, Stephen Eugene Foley was found guilty by a jury of aiding and abetting his construction companies (HPTP 2014 Ltd and Point to Point Construction Ltd) of deducting PAYE from employee’s wages but not paying it to IRD.

“From December 2014 until April 2017, Foley deducted PAYE from his employees’ wages but failed to pay this to Inland Revenue. The total PAYE withheld across both companies was $481,964.57 but the total amount that remains outstanding is $356,132.18,” reported the IRD.

He was sentenced to 25 months and 2 weeks’ imprisonment and ordered to pay $120,000 to IRD.

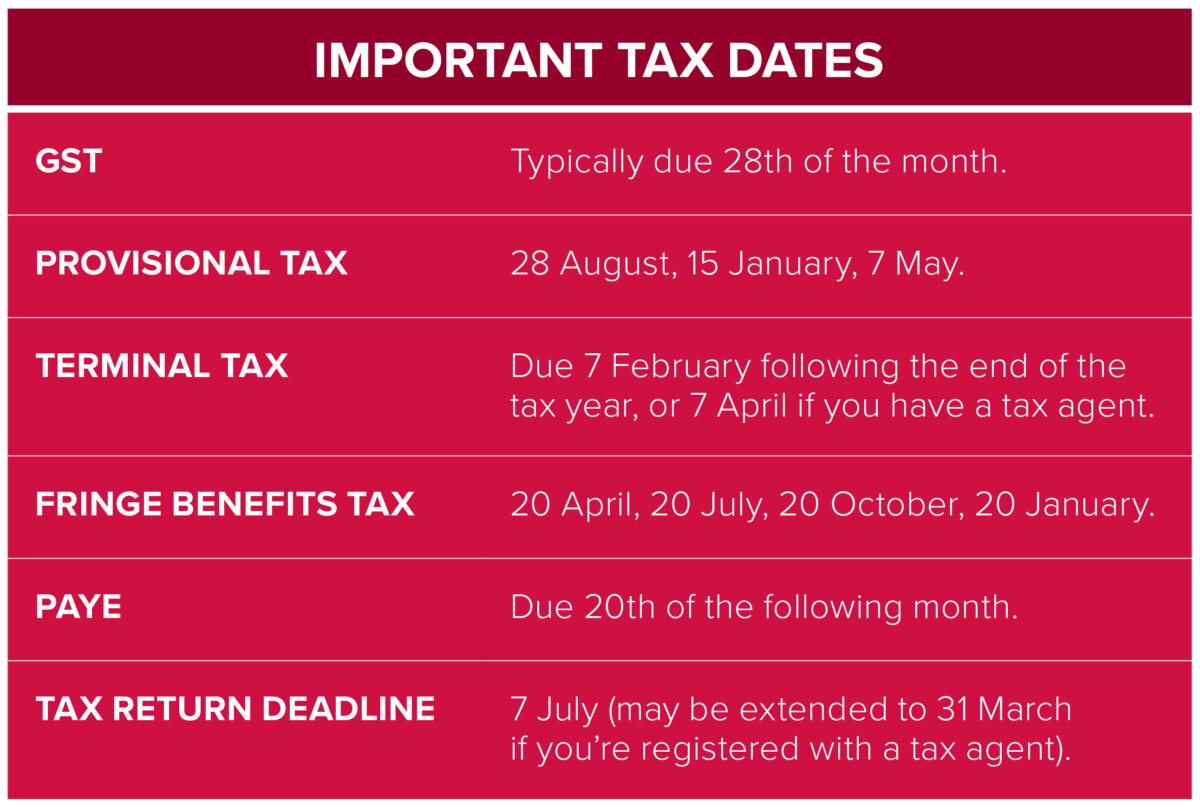

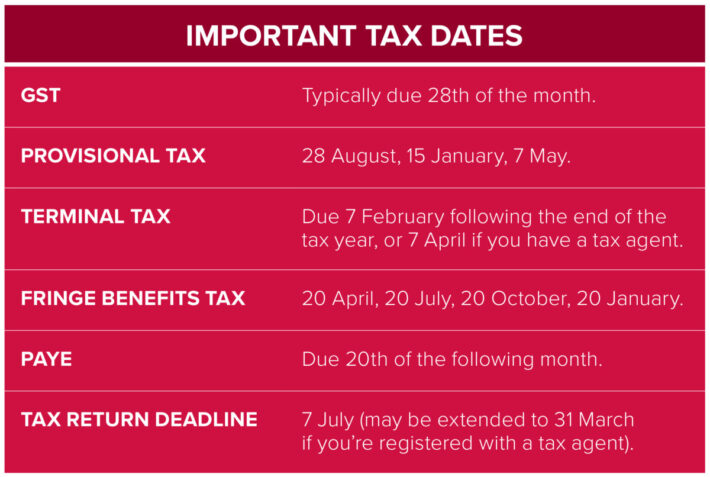

Important tax dates

Register to earn LBP Points Sign in