WHEN DID THE DAMAGE OCCUR?

21 Jan 2020, Insurance, Learn, Prove Your Know How

Builtin looks at what events can trigger a public liability insurance claim, how this is determined, and what this means when it comes to cancelling insurance

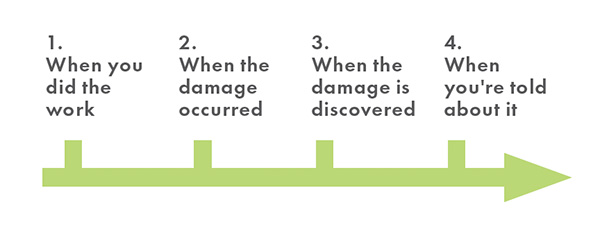

There are a few key triggers that must be met before your public liability insurance claim can even be considered. First, the event which triggers the claim must be within the policy period. This can be a source of misunderstanding, because there are often a few different events associated with a claim, so you need to understand which is the important one.

Different events:

The only important event when it comes to a public liability claim is when the damage actually happened. It doesn’t matter when you did the work, when the damage was discovered, or when you were told about it. The claim should still be made under the policy that was in place when the damage occurred, even if it was years earlier.

An example

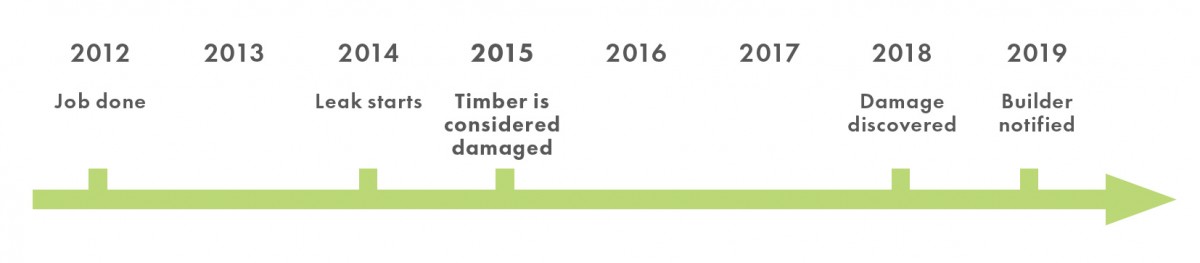

A renovation of a residential property was completed in January 2012. In 2018 a leak was discovered; it had taken time to penetrate internal linings and only came to light after discolouration started to appear. It was determined that the leak began sometime in 2014, with damage to the framing timber starting in 2015 after months of being wet. The homeowner made a claim on their insurance, which was declined, so the homeowner notified the builder in January 2019 that they would be holding him liable for the repair costs.

In this case, the builder needs to claim on the policy he had in place in 2015. Even if he has changed insurers in that time, the insurer of the policy he had in 2015 should be the one to respond to claims for events during that policy period, even if the claim is made years later. If he had cancelled his policy in 2013 after the job was finished, but before damage had occurred, he would have no cover as the event triggering the claim (ie, when the damage occurred) happened in 2015.

When does wet timber become damaged?

Most of the time, it’s easy to identify when the damage occurred. It’s when you dropped the rangehood onto the induction cooktop, or when the digger hit the underground pipe. In other situations, it can be very difficult – as with timber that gets wet and rots.

In a famous legal case between Arrow International and QBE, the judge decided that damage occurs when there has been “an alteration to the physical state of the timber which impairs its value or usefulness as a component

in the building”. This is not necessarily when it first becomes wet or even when it is discovered. The judge said that damage had clearly been suffered when rotting of the timber had occurred. There is also a reference to “de minimis”, which basically means the damage has to have reached a minimum threshold for it to be considered as such.

The judge indicated that, in the absence of any expert advice to the contrary, damage to timber is deemed to occur within 6-18 months of completion of the work. It was further agreed that once a building starts to leak, there will be enough moisture in the wood to promote fungal growth within three to six months. During the next six months, decay will advance so that it is well under way; such that the strength of the wood is compromised. Physical damage, in terms of the policy, has occurred by then, although “each case must be examined on its own facts”.

Gradual damage/deterioration exclusion

Unfortunately, since this case most insurers have added an exclusion to public/general liability cover (and to domestic house policies) that excludes claims from gradual deterioration, such as rotting timber.

However, there is always the potential for delayed damage claims from other events.

In a nutshell

One of the key triggers for a liability claim is that the damage must have occurred during the policy period. In some cases, this can happen months or years after the job was done. This is why it’s a good idea to keep your cover in place for a while after you’ve finished the job, including after you retire.

Builtin are New Zealand’s trade insurance experts. For more information visit www.builtin.co.nz, email Ben Rickard at ben@builtin.co.nz or call him on 0800 BUILTIN.

Register to earn LBP Points Sign in

4 Comments

Leave a Reply

You must be logged in to post a comment.

Done

Good

Brilliant

done