TO CAP OR NOT TO CAP — BCA LIABILITY

16 Jul 2019, Industry Updates, News

Proposed building reform suggests liability settings for Building Consent Authorities (BCAs) should remain unchanged despite considering 20% cap

When things go wrong in the building process, liability settings determine who pays to resolve the issue and how disputes are resolved.

New Zealand has joint and several liability, which means that if two or more people have contributed to a defect in a building and one cannot pay their portion, the amount can fall to others involved.

Over the past few years, BCAs have complained that this system results in them footing an unfair amount of the bill for building defects, and MBIE has received concerns that this leads to risk-adverse consenting.

Painting by numbers

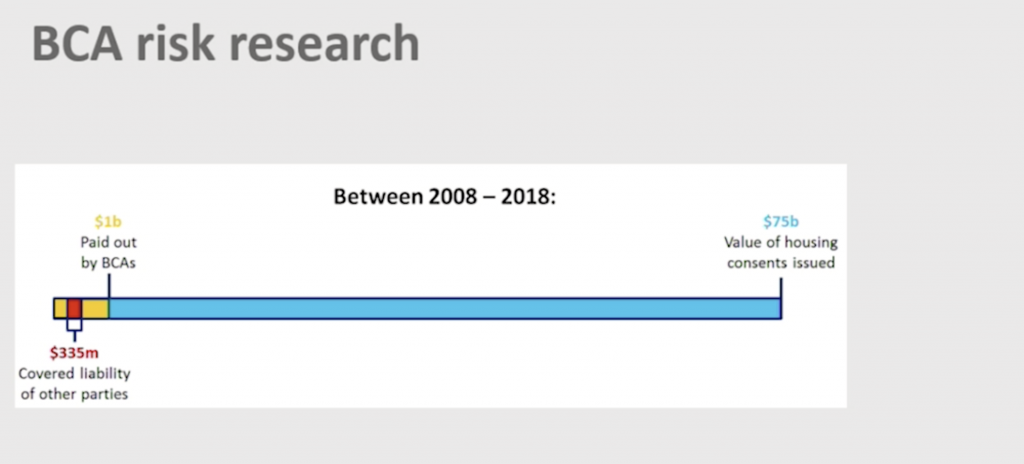

Findings released from Sapere Research Group, spanning the previous ten years, show building defects have cost an accumulative $1bn in compensation for building consent authorities.

Of that total, close to a third was to cover builders and developers who had failed in their operation and avoided their responsibility, with councils usually the last entity remaining to foot the bill.

However, the total value of consents issued by BCAs during that period – between 2008 and 2018 – was approximately $75bn.

The research estimates that there were nearly 8,800 building defect disputes between 2008 and 2018, which included the peak of leaky homes litigation that involved $3.8bn of damages for residential properties.

Along with BCAs being left with the bill for other failed parties, homeowners ended up covering costs totalling $458m.

Sapere’s research covered 138 disputes, primarily in the Weathertight Homes Tribunal and others in the High Court, all with a total value of $145m. Sapere extrapolated the data going by the assumption that 95% of disputes were settled before a hearing and that settlements would typically result in a smaller payout.

It said that builders and developers are typically ordered to pay around a third of awarded damages. However, research suggested they avoided such responsibilities 48% and 68% of the time respectively.

“Concern is often raised about BCAs being the only party left to compensate homeowners when building defects arise. This can mean that the total amount paid by BCAs is disproportionate to the role they played in contributing to that defect,” said Fiona Hill, Building Policy Team Leader at MBIE.

Cap deemed unnecessary

Due to this situation, MBIE considered the option of including a 20% cap on BCA liability in the recent building reform package. However, such action was viewed as unnecessary and the reform suggests the liability settings for BCAs should remain unchanged.

According to Hill, this is because other proposals in the building reform package aim to make people more accountable for their work and products, so it is estimated that this will reduce BCA’s potential liability.

Hill also noted that only $335m of the $1bn paid out by councils was to cover the cost of defects incurred by other parties who were unavailable to pay their share of the claims, and that BCAs received $75bn in consent fees over that same period.

Ultimately, MBIE’s research found that around 2.5% of residential building contracts resulted in disputes settled in court, or by other disputes resolution processes, and that court cases involving building disputes have been steadily decreasing since 2012 as the leaky building crisis recedes.

The planned building law reforms announced in April, which aim to deliver a safer and higher performing building sector, was accompanied by a 190-page discussion document and supporting reports that included the Sapere research.

Register to earn LBP Points Sign in